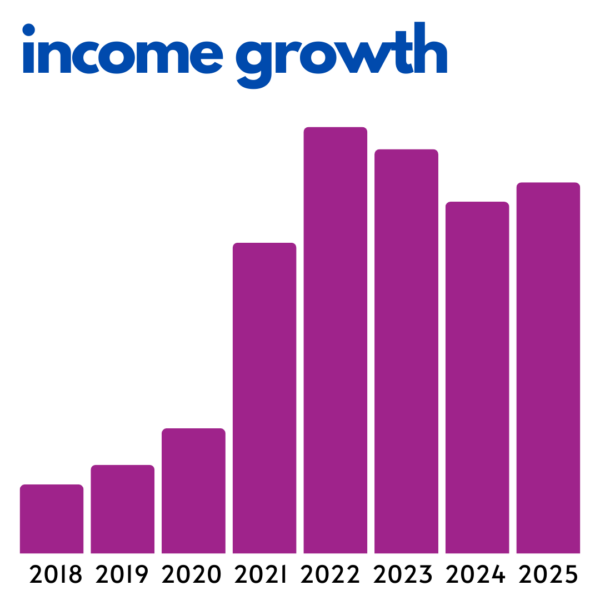

Today I’m sharing a breakdown of my 2021 quilting income, as I’ve done for the last three years (2020, 2019, 2018). Some notes and context:

- I have a full-time job and do not rely on quilting as a primary income source for our family.

- Because my quilting income is supplemental, I may have different priorities and make different decisions than those for whom quilting is a full-time job.

- That said, I firmly believe in being fairly compensated for my time and effort and rarely work for free.

- The income breakdown below is based on gross income, before expenses and taxes.

—–

In 2021, my total quilting income increased by 150%! That’s a pretty huge leap, so let’s break it down….

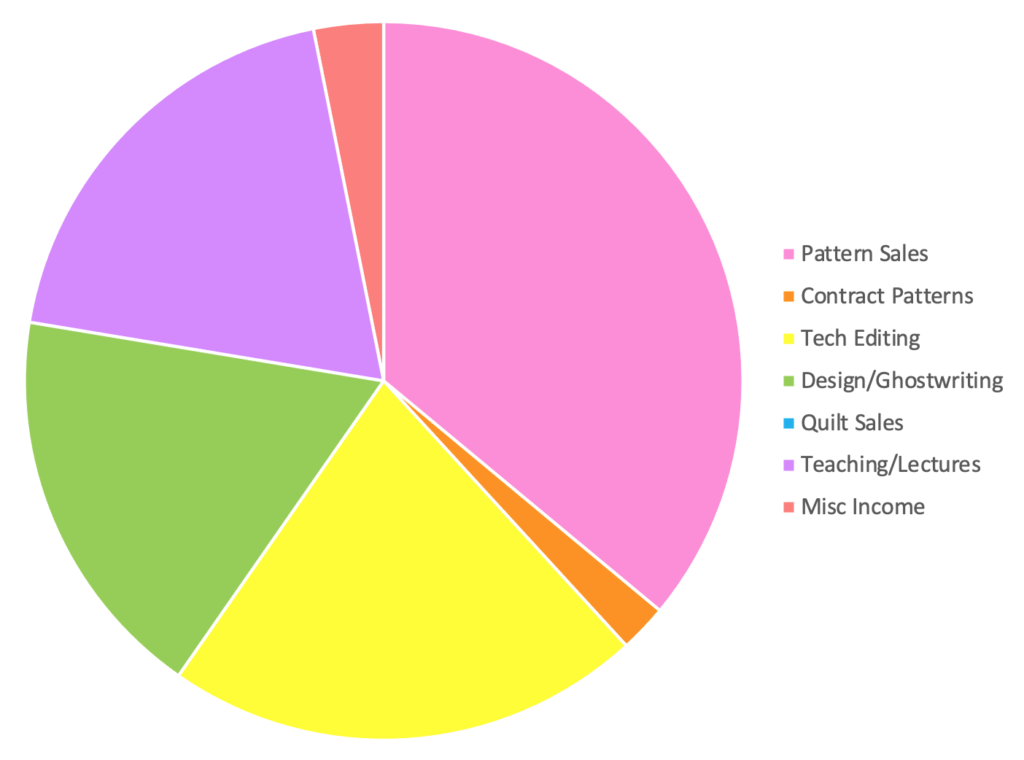

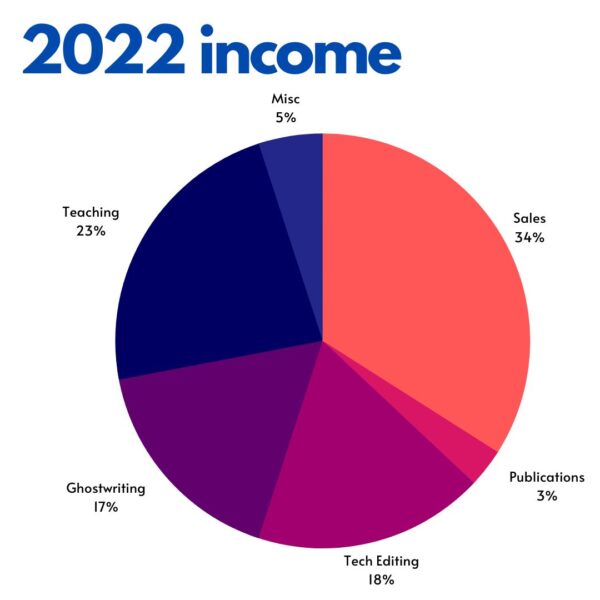

Pattern Sales – 36% (Last year: 26%)

This includes income from my patterns that are listed on Etsy and Quilt Pattern Mart.

I continued working fairly diligently on patterns this year, and my income in this category more than tripled from last year. I continued to add print patterns as well, which allows me to sell wholesale to shops and distributors. I mentioned in a previous post that I was picked up by Checker Distributors late this year, and I hope that will be a fruitful relationship in 2022.

I started the year with 6 patterns in my shop and added 4 more for a total of 10. Ideally, I’d like to add another 3-4 in 2022.

Contract Patterns – 2% (Last year: 26%)

These are patterns/tutorials I wrote under my own name, but for someone else. Craftsy was my primary client for this type of work but with their demise in 2020, that relationship obviously went away. (The second reason for the drop is that previously I included ghostwriting in this category but I’ve broken that out separately this year.)

Tech Editing – 21%

Ghostwriting & Design – 18%

(Last year combined: 30%)

There are two primary “flavors” of services I provide to other quilt pattern designers. Tech editing applies when people send me their nearly complete patterns for an edit — fairly self-explanatory. Ghostwriting & design is where I capture everything else — pattern design and layout, diagrams and illustrations, all the way up to full ghostwriting. It’s really whatever people need to get their pattern ready to go. I continued to both work with previous clients and pick up several new ones thanks to referrals.

I did dozens of tech edits, and fewer than 10 ghostwriting/design projects, but ghostwriting/design takes significantly more time per client so interestingly, these two categories came out about equal.

Quilt Sales – 0%

I didn’t sell any quilts this year, nor did I make any on commission.

Teaching – 19% (Last year: 8%)

Prior to this year, my teaching had been limited to classes at my local shop and one virtual session in 2020. This year I gave lectures to 20 different guilds and taught 1 guild workshop, and as a result my teaching income increased by 470%. Wow.

I have 6 engagements currently on my 2022 schedule, including QuiltCon. I have really enjoyed getting into this part of the quilting world and I’m hopeful that I’ll be able to sustain something like 10-12 engagements per year going forward. I have minimal interest in traveling for guild lectures/workshops since that would be a big impact on my family and day job, so I’m curious to see whether the desire for virtual content remains strong as covid drags on.

Other – 3% (Last year: 10%)

This category is the catch-all for anything that didn’t quite fit into one of the other categories — like the prize money from my PIQF award! That was a nice surprise.

—–

This year I thought I’d add a breakdown of my expenses as well. I haven’t done this in previous years, but it definitely helps present a fuller picture of quilting business finances! The expenses below add up to 18% of my gross income, i.e. if my gross income was $100, I spent $18 in expenses for a net of $82. Notably, these expenses DO NOT include federal income tax, which I will calculate and pay as part of our family’s income tax filing this spring.

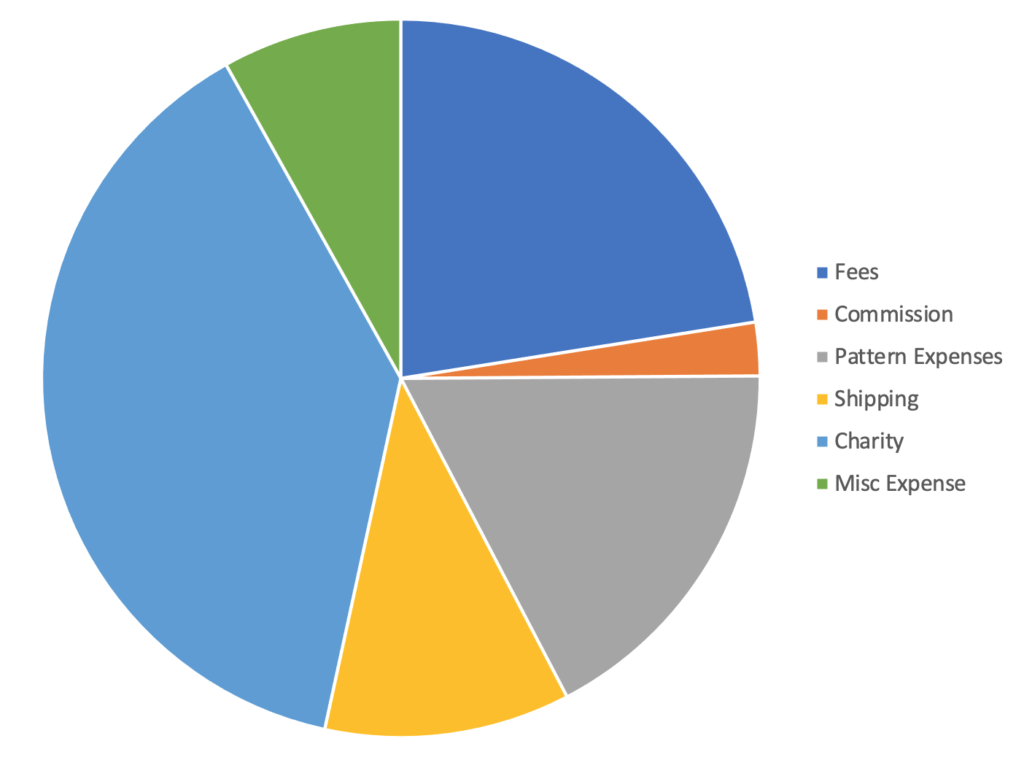

Fees – 22%

There are three primary sources of fees in my quilt biz:

- Paypal — I invoice nearly all of my tech editing and ghostwriting clients via Paypal, and they charge fees for all of those transactions.

- Etsy — There are fees associated with each of my listings, and fees that are charged each time I make a sale.

- Quilt Pattern Mart — There is a banking fee associated with my sales on this site.

I have looked into non-Paypal and non-Etsy options but have yet to find anything that would lower my fees in a meaningful way. If I continue to increase my sales, there are some options that may begin to make sense, but to an extent, this kind of thing is just a cost of doing business.

Commission – 3%

Quilt Pattern Mart charges a small commission on each sale.

Pattern Expenses – 22%

This includes the cost for all of my print patterns and the cost of having all of my patterns (print or digital) tech edited. I can’t effectively edit my own patterns!

As for printing, thus far it has not made sense to print more than 100 copies of a pattern at a time. If my sales increase to the point where I’m able to order in batches of 500-1000, the cost per pattern starts to decrease quite a bit, but I’m not there now.

Shipping – 11%

This one is fairly self-explanatory. It includes both the postage I pay to mail print pattern orders and the shipping materials themselves like envelopes and pattern bags.

Charity – 38%

I donate a portion of my pattern sales each month to a charity I’ve chosen, which I announce each month in my email newsletter. It’s pretty awesome that this category is my largest expense!!

Miscellaneous Expenses – 8%

This category is another catch-all. One of the things included in this category this year is the fee for a newsletter provider that I’m trying out. I’d like to work on growing my email list, and this provider has a set fee no matter what the size of the list.

—–

So that’s my 2021 breakdown! This is always a good exercise for me to look back and think about how I have earned and spent business money this year, along with what is and isn’t working. I’ll have more thoughts on goals for 2022 later this month!

p.s. I’m doing a 31 day blogging challenge.

I appreciate you doing all of this and I’m not into quilting but I would like to turn my art into a business at some point. The thing that throws me and prohibits me from wanting to do it is the taxes part—I have no idea how to separate out all of that or if I need to file different than our typical income taxes. Do you have an LLC for the business? I just want a website that lays it all out and I can’t find that! Even the state business site for sales tax is confusing!

I don’t have an LLC, and simply report my quilt stuff as self-employment income along with the rest of our family’s income. Now I’ll add a HUGE caveat that I don’t know if I am doing this right. I’ve never consulted with a tax person about it and at this point I probably should, as my 2021 income is significantly larger than any previous year. That said, it’s still <10% of our overall household income given that we have two working adults in professional white collar jobs -- so from a federal tax perspective, the amount I owe on my quilting income is only a small chunk of our overall tax obligation. So for better or worse (and I recognize this is a potentially sketchy opinion) I figure that as long as I'm getting pretty close I should be ok.

As for sales tax, Etsy is at least partially helpful, as they calculate and collect the sales tax for many states. I admittedly need to do a bit more research in this area as well to make sure I am fully covered, but I think I'm close. That's for my pattern sales aka physical/digital products. For the editing and design services, my understanding is that Texas does not require me to collect sales tax on those.

Please don’t take this as concrete tax advice, but you may want to look and see if your city/county/state requires you to have a business license and pay net profits taxes, as well.

I agree that it’s going to be interesting to see if demand for virtual content with quilt guilds is going to continue. I also really benefitted from and enjoyed pivoting to teaching online. Thanks for sharing your breakdown each year!

That is really interesting! For me who has no business (nor do I intend to have one) I always wondered how this was sustainable… I am wondering, though, as I don’t see fabric buying in the expenses? Surely it is required, to make pattern and course samples? And it must be a lot!

A commenter on Instagram made me realize I didn’t include that category, and need to remedy it. My materials costs (fabric, batting, thread) are more difficult to track because I do quite a bit of quilting that is NOT for my business. In addition, I have received some of these materials from companies in the industry that I have built relationships with, so I did not have to pay for every bit of fabric, batting, or thread that I used.

Material costs for business-related quilts would shift my expense pie chart, but as a rough estimate it represents no more than 8-10% of my total.